An employment separation is the end of an employee’s working relationship with an employer. It includes voluntary separations (i.e., resignation or retirement), involuntary separations (i.e., firing or layoff) and departures that occur at the expiration of a work contract or seasonal employment. Employment separations require employers to complete a variety of

important tasks in a short time frame, including finalizing payroll, retrieving company property and transferring the departing employee’s job responsibilities. Employers must also address issues related to employee benefits for departing employees.

In general, employee benefits end when workers separate from employment, regardless of the reason for the separation. Unused balances in health flexible spending accounts (FSAs), dependent care FSAs and health reimbursement arrangements(HRAs) are typically forfeited, subject to a run-out period for submitting claims. Health coverage may be continued under the

federal Consolidated Omnibus Budget Reconciliation Act (COBRA) or a similar state continuation coverage law, if applicable. Other employee benefits, such as group life insurance, may be subject to conversion rights.

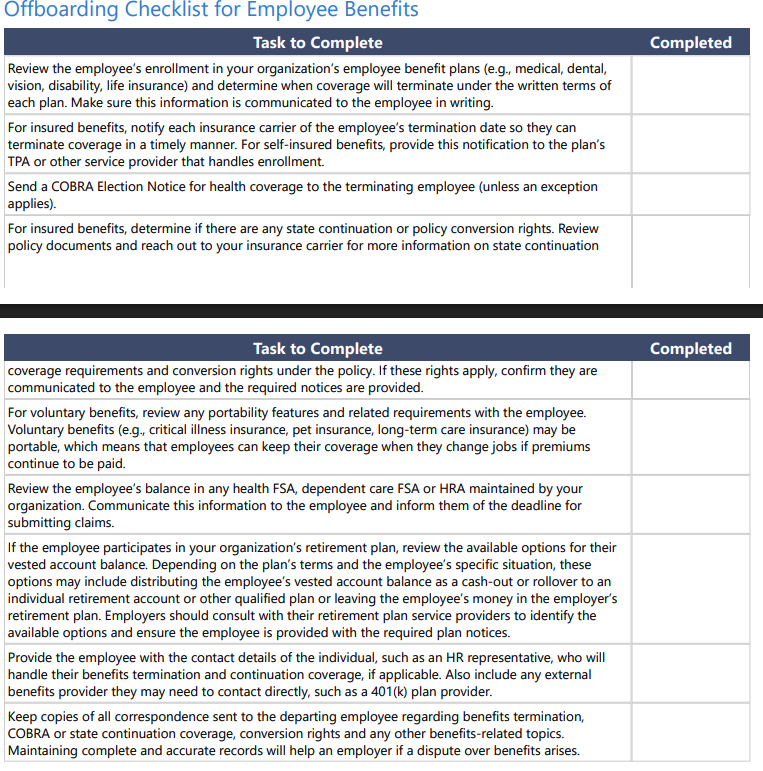

To help ensure all critical tasks are addressed, employers should implement a standardized offboarding process that includes essential steps regarding employee benefits

Key Compliance Tips

Follow the Plan Document’s Eligibility Rules

To comply with the Employee Retirement Income Security Act (ERISA), benefit plans must have an official written plan document that describes the plan’s benefits and guides day-to-day operations. The plan document often comprises multiple documents, including benefit descriptions provided by an insurance carrier or TPA, and a “wrap” document that combines

multiple benefits under one welfare benefit plan and satisfies ERISA’s documentation requirements. Following the written plan document in the day-to-day operations of the plan is a fiduciary duty under ERISA.

The plan documents should address when coverage ends following a loss of eligibility, such as an employment termination. Coverage often ends on the employee’s termination date or at the end of the month in which the separation occurs. As part of the separation process, it is crucial for employers to provide written notification to employees that their benefits will terminate, including details on when coverage ends and any continuation or conversion options. Employers should also inform their insurance carriers and TPAs of eligibility changes so they can process coverage terminations and address any administrative responsibilities.

In some situations, employers may want to continue health coverage for terminated or laid-off employees as part of a severance package. The most straightforward way to approach this is by providing an employer subsidy for COBRA (or state continuation) coverage for a specified length of time (e.g., six months). Allowing former employees to continue active health

plan coverage is challenging because a health plan’s written terms generally would need to be amended to permit such coverage. Changing the plan’s eligibility rules can be complicated by any applicable nondiscrimination testing rules and restrictions imposed by an insurance carrier, including a stop-loss carrier for a self-insured health plan. Also, going beyond the

plan’s written terms without prior written approval from the plan’s insurer may inadvertently create liability for the employer if the insurance carrier denies claims based on the individual’s ineligibility for benefits.

Offer Continuation Coverage

Employees who separate from employment may have the right to continue health plan coverage under federal or state continuation coverage laws. COBRA is a federal continuation coverage law that applies to health plans maintained by private sector employers with 20 or more employees. Health plans include fully insured health plans, self-insured health plans, level funded health plans, dental and vision plans, health FSAs and HRAs. COBRA does NOT apply to health plans maintained by small employers (fewer than 20 employees) or churches, although state continuation coverage requirements may apply to

these plans if they are insured.

COBRA requires group health plans to offer continuation coverage to employees and their covered spouses and dependent children (collectively, qualified beneficiaries) for up to 18 months when their coverage would otherwise end due to a termination of employment, whether voluntary or involuntary. If COBRA rights apply, employers should ensure a COBRA

Election Notice is sent to qualified beneficiaries on a timely basis. In general, a COBRA Election Notice must be provided within 44 days of the employee’s termination date or the date coverage would otherwise end, whichever is later. As a practical tip, COBRA election notices should be sent to qualified beneficiaries as soon as possible. The sooner the notice is sent, the sooner the qualified beneficiary may be required to make an election.

Most states have their own continuation coverage laws that apply to insured group health plans of smaller employers. If state continuation coverage rights apply, employers should ensure the required notices are provided to terminated employees.

Inform Employees About Conversion Rights

Group insurance policies may allow employees to convert their group coverage to an individual policy when their employment ends without going through an approval process. Group life insurance policies often include conversion rights. There is often a

strict deadline (e.g., 31 days after termination) for employees to apply for a conversion policy and pay their first premium. The availability of conversion rights and the related election process are generally dictated by the terms of the insurance policy.

Under ERISA, employers administering their employee benefit plans have a fiduciary duty to act solely in the interest of plan participants and their beneficiaries and with the exclusive purpose of providing benefits to them. Some courts have held that employers breached their ERISA fiduciary duties by failing to provide employees with accurate and complete information about their conversion rights. As a remedy, these courts have required employers to pay out lost life insurance benefits (plus interest and attorney fees). To help avoid liability, employers should review their group insurance policies’ conversion rules and any related administrative procedures. Moreover, employers should ensure that employees are provided with written notice regarding their conversion rights, including any election deadlines, at the time of termination.

Understand the Rules for FSAs and HRAs

Most health FSAs, dependent care FSAs and HRAs are structured so employees forfeit any unused balances remaining in their accounts when their employment ends, subject to a run-out period for submitting claims that were incurred prior to their termination date. Employers should review their written plan documents to determine the specific rules that apply to their

plans. As an optional feature, HRAs may be designed to allow former employees to spend down their account balance for claims incurred after termination of employment.

Health FSAs, dependent care FSAs and HRAs are never permitted to cash out unused balances, even when an employee terminates employment with a large balance remaining in their account. Doing so can jeopardize the account’s tax-advantaged status. Also, employers must offer COBRA coverage for their health FSAs or HRAs unless an exception applies.

Health savings accounts (HSAs) are different than health FSAs and HRAs in that they are individually owned accounts rather than employer-sponsored plans. Employers that sponsor high deductible health plans that are compatible with HSA contributions may want to remind their departing employees that their HSA balance is not impacted by their termination.